Some thoughts from the perspective of an equity and industry investor

August 2022

Post by Marek Kotelnicki

In the world of innovators there are a few words that define the future. One of them is certainly photonics. Its applications are extremely wide and can make almost every industry more competitive (if not all). If it doesn’t sound convincing, let’s add to all above the economic factor – photonics market was valued to USD 593.7 billion in 2020 and is projected to reach USD 837.8 billion by 2025, growing at a CAGR of 7.1% between 2020 to 2025. What’s more – Europe is very active on the photonics industry and it’s reflected by its position of the second largest producer of photonics products.

Photonics – the science of creating, manipulating, transmitting and detecting light that is literally everywhere, from smartphone displays to fibre-optic broadband to energy-saving LED lights to the laser surgery that saves our life. As light particles (known as photons) replace electrons in many of our most important technologies, innovations already in the pipeline will improve healthcare, grow food, save energy, cut pollution, expand connectivity, transform manufacturing and usher in a new era of mobility. – Europe’s Age of Light!, Photonics21.

Why is photonics the future?

Interesting data on the photonics industry is presented in Europe’s Age of Light!, Photonics21 (I highly recommend you the report). Its authors claim that there are 5,000 technology-intensive companies (many of them SMEs) which directly employ over 300,000 people on this market and that the global market share of 15.5% leaves Europe second to China.

“Photonics will be at the very heart of digital transformation, providing tools and solutions to literally every industry in every region in Europe that takes up the challenge to become more competitive.”

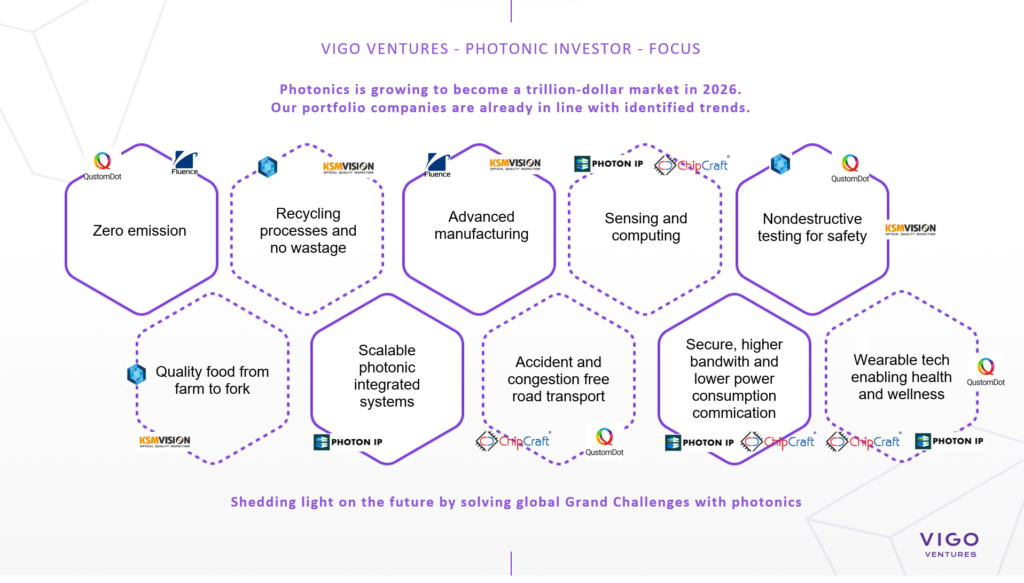

This general overview is very promising, so let’s look at it more closely. To be more specific, at Vigo Ventures we have analyzed most important trends in photonics branch in accordance to global grand challenges which can be overcome with its help. In the effect, we have build a strong portfolio of “photonic entities” functioning in different areas and being a part of an almost $ 700bn photonics market. Among these areas, it is worth noting, for example, the following:

- Laser systems: complete products using lasers or laser sources and solutions improving laser parameters.

- Scanning, sensing, detecting, imaging: Precise measurements, imaging and detection in various applications on the ground and in space. Example sectors the use of new approaches can be found: advanced manufacturing, transportation, environment and energy, aerospace, healthcare, agri-food industry, security and defense, telecommunications, construction, scientific installations, R&D Centers.

- Infrared: Solutions using or that could benefit from precise IR technology, there is high potential in mid-wave infrared (MWIR) or long-wave infrared (LWIR). With applications present in industry, defense and security, environmental protection, healthcare, transport and R&D.

- Semiconductors: Focus on III and V group or based on pure silicon; components for devices, solutions using the properties of certain semiconductors.

- Materials science: Technology enablers or complete products in a wide spectrum of applied physics and chemistry with identified customers, that can be found across many industries like aerospace, armed forces and defense, automotive, manufacturing, nuclear industry, oil and gas, pharmaceuticals, telecommunication.

- Quantum technologies: Technology enablers or complete products and solutions that can be used for a identified problem within a given sector – like next generation of computing and communication, security, scientific installations, R&D centers, energy, display, advanced manufacturing, automotive industries.

When it comes to the most important technologies, we’re particularly enthusiastic about these from the graph below:

A company that is active in the field of displays is Noctiluca. Displays that can be used for wearables, as well of larger screens is a competitive and growing market as well as a price sensitive one. Having the possibility of introducing a material or technology that is compliant with the existing manufacturing processes and can lower the cost and enhancing the parameters of end devices is interesting for the industrial players. Development of companies like Noctiluca, Kyulux or Cynora delivering OLED solutions to the display market or for that matter companies like QustomDot, Nanosys or Nanoco delivering quantum dots also for the display world prove that there is a need for more efficient solutions as well as room for innovation in this complex environment. Finding a way to enter the value chain is at most importance.

Europe is on the photonic path and knows how to overcome its challenges

The hardware investment game right now becomes very interesting, where strategic foresight becomes more important than ever because of the investments that are done in uncertain times. The local investor ecosystem knows the market ins and outs and looks to engage with international partners when the time is right. Preparing the companies and technologies for growth is the true challenge that needs to be addressed early on. International investors are looking for technologies solving certain future problems that are not detached from production reality. So having dedicated founders and engaged investors is what make the attractive formula to scale a business with potentially less risk engaged. European market is innovation driven but has its limitations when it comes to full commercialization path of hardware products. That’s why the markets for these kind of companies are global ones and preparation for the longer journey is needed to be done earlier. To make it even more tricky only a part on the growth capital is accessible from European investors – so having a clear funding path is crucial. When driving hardware (and photonic for that matter) companies you need to understand very well where and why the market is going and what competences in founders and investors will be needed in the future to help you deliver on the growth promise. Key competences on the technology development and understanding how to use physics for the benefit of the industry are here in Europe, now it’s time to take advantage of the strong core and build on it.

Europe is strong in tech and especially strong in hard and deep tech. Talented engineers from European countries are working for the biggest in the industry across the world. In this turbulent reality and shifting geopolitical strengths the relation with different international investors and the markets you address is equally interesting as difficult. Despite where you are from, “doing your homework” on the product market fit – the market being the global one – should be on your 1st priority list – know your market and its mechanism it will help you with planning and being resilient.

In my perspective what we try to do as VIGO Ventures in our small contribution is to create bridge possibilities for the brilliant tech to be ready for expansion – happy to discuss how to bring this vision closer to reality.

Next steps

Photonic is the future. That’s the reason business goal ahead of VIGO Ventures is to multiply its current portfolio by a factor of three by 2024. Now we have 6 companies. Our investment tickets go up to 1mln€ for pre-series A companies. One other very important thing is a proposition for the very early-stage photonic companies. We are finalizing it with our partners now – it’s an accelerator type of offer that light speeds your way to next round funding readiness. Investor that is acting as advisors and additionally putting our money where our mouth is by investing private equity – across Europe – a natural step for us but a very important one for the community we believe. When it comes to Noctiluca the vision is clear because the market is here. Establish firm relations with key partners in the value chain, and with their ongoing projects prove that their solution meets the specs and is implementable.

I hope that more EU based investors will take on the challenge and invest in Hardware & Deep tech. We know that the willingness from financial investors is there but these kind of projects need to be significantly de-risked and this is where guys like us enter the ring.