August 2023

Blog post by Noctiluca.

The biggest technology manufacturers invest significantly more in the development of their products than entire countries do in R&D. This level of investment contributes to the long lifecycles of leading technologies, which are perfected over decades to reach their full potential, however it also means that it takes a long time to return the incurred R&D costs.

Sector that is now entering such a rapid growth phase is OLED – short for organic light-emitting diode. OLEDs are constructed using an electroluminescent layer of organic and metalloorganic compounds that emit light when exposed to electricity. Unlike LCD technology, OLED-based panels do not require backlighting due to their inherent light-emitting properties.

While not widely known, it was Kodak that originally invented OLED technology. In 1987, Kodak’s chemists, Ching Wan Tang and Steven Van Slyke, developed the first practical OLED device (source). Despite being an early pioneer, the company failed to capitalize on the first mover advantage and in December 2009, Kodak announced sale of its OLED business to LG for $100 million (source).

OLED: Seizing a Larger Slice of the Market

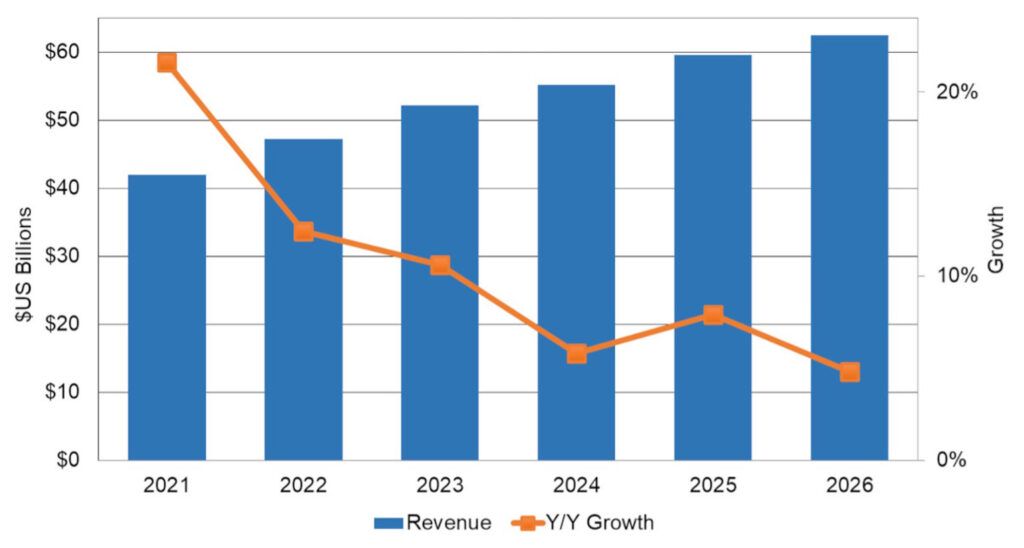

LG Display’s decision to invest in OLED technology years ago has proven to be a resounding success. The global OLED displays market is on an upward trajectory, projected to reach a value of $72.8 billion by 2026 (source) and 136.49 billion by 2030 (source).

The rapid growth of this market is primarily fueled by the soaring demand for OLED displays in a wide range of devices, including laptops, monitors, smartphones, wearables, and TVs.

Source: DSCC

Among OLED devices, smartphones stand as the largest segment for OLED technology use. The smartphone display market continues to grow in value due to constant technological advancements, the increasing popularity of mobile entertainment and remote work, and a decline in the popularity of larger laptops and computers.

Source: Lighting – LG Display, Marketing materials – Inuru.com

Following smartphones, the second-largest segment for OLED displays is TVs. The global OLED TV market is expected to reach a valuation of $50.4 billion by 2030 (source). The rising trend in high-end consumer electronics and the surge in end consumer income in emerging economies contribute significantly to the increasing demand for OLED TVs.

With OLED already dominating the smartphone and high-end TV markets, it is now time for broader adoption in other areas, such as wearables and flexible electronics. The technology’s versatility allows it to be applied to tablets, monitors, VR sets, as well as for medical and automotive applications. Furthermore, an ultimate revolution is expected with the takeover of the lighting and design/marketing markets.

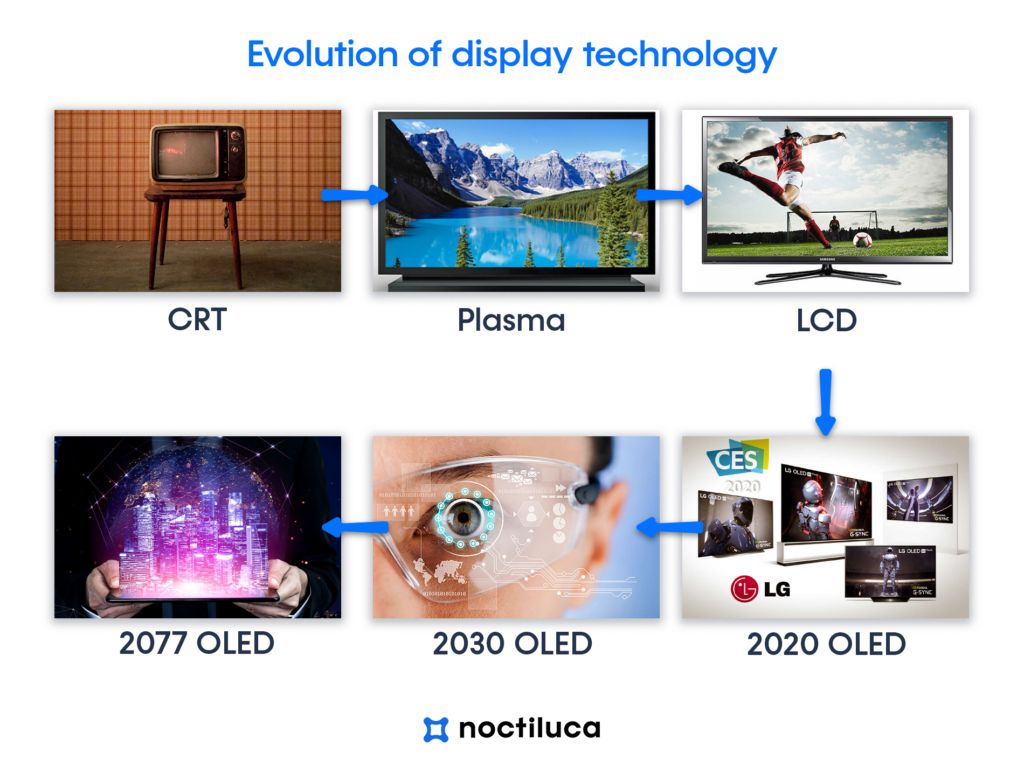

Why OLED Is Gaining Popularity

OLED is a highly versatile technology with tremendous potential. In fact, virtually all premium devices currently on the market feature OLED displays. So, what sets OLED apart? In comparison to LCDs, OLEDs do not require a backlight, making them much thinner and allowing for larger display sizes. Additionally, OLED displays can be rigid, flexible, transparent, foldable, rollable, and more. As we consider the displays of the future, eco-friendliness is a must. OLED technology addresses this by utilizing organic compounds, offering higher energy efficiency, and boasting a longer life cycle to other display technologies.

Furthermore, OLED displays deliver improved image quality, including enhanced contrast and brightness, deep blacks, wider viewing angles, and a broader color range.

We’ve shared more on this topic in another post HERE

Source: Plasma TV, OLED 2020, OLED 2030, LCD

OLED: A Technology Worthy of Investment

The factors mentioned above have led to significant investments in OLED technology. Over the past five years, major players including LG, Samsung, TCL, and Apple have collectively invested at least $38 billion in OLED capacity. Additionally, in April 2023, Samsung announced plans to invest $3.14 billion until 2026 to manufacture advanced OLED display panels for tablets and computers (source). However, it’s not just the major players who are betting on this technology. OLED is becoming increasingly common, not only in traditional production but also in inkjet printing.

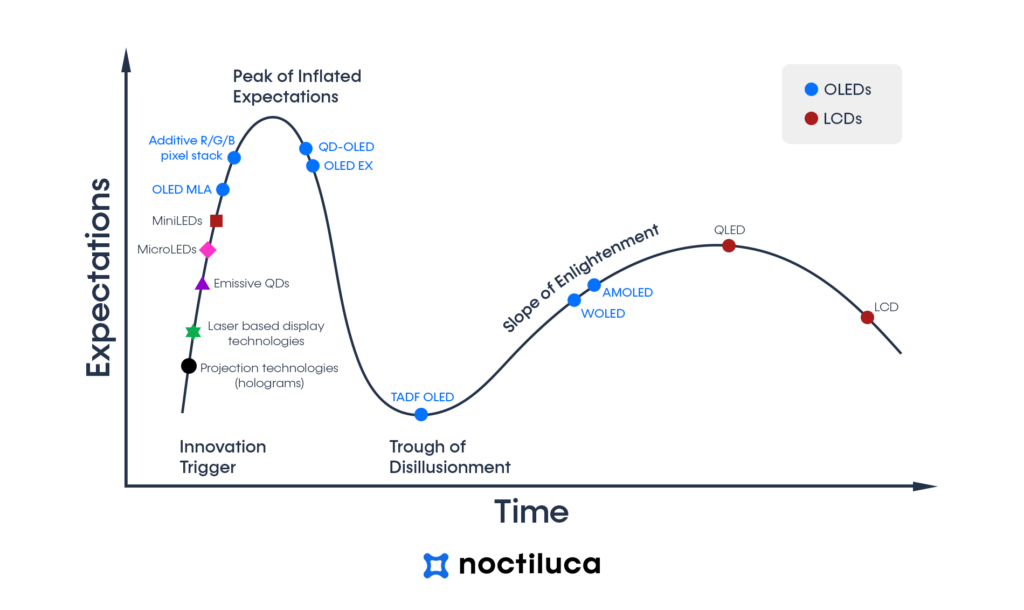

Any investment must ultimately yield returns, which is why technologies, depending on their applications and versatility, require several years or more to reach their full potential. At Team Noctiluca, basing on Gartner’s Hype Cycle® model, we attempted an approximation of the state of the art to gauge the life cycle of various display technologies present to varying degrees in the market.

Our analysis considered various OLED technologies, LCD technology, as well as emerging technologies like MiniLEDs, MicroLEDs, laser-based display technologies, and more.

Based on our analysis, we assert that LCD technology has already reached its maximum possible performance. Despite the high level of technical advancement of LCD matrices, they still require image enhancement mechanisms and offer relatively low contrast and poor black reproduction.

Considering the level of investment by manufacturers, the growing interest in OLED technologies from users, and the rapid development of different forms of displays, we estimate that there are at least two decades of OLED technology dominance ahead. Additionally, the fact that OLED matrices have already dominated the smartphone display market and are starting to displace other technologies in the TV display market further supports this projection.

If Gartner’s hype cycle® were to depict the life cycle of different display technologies, it might resemble the following analysis.

How do Hype Cycles work?

Each Hype Cycle drills down into the five key phases of a technology’s lifecycle.

- Innovation Trigger: A potential technology breakthrough kicks things off. Early proof-of-concept stories and media interest trigger significant publicity. Often no usable products exist and commercial viability is unproven.

- Peak of Inflated Expectations: Early publicity produces a number of success stories — often accompanied by scores of failures. Some companies take action; many do not.

- Trough of Disillusionment: Interest wanes as experiments and implementations fail to deliver. Producers of the technology shake out or fail. Investments continue only if the surviving providers improve their products to the satisfaction of early adopters.

- Slope of Enlightenment: More instances of how the technology can benefit the enterprise start to crystallize and become more widely understood. Second- and third-generation products appear from technology providers. More enterprises fund pilots; conservative companies remain cautious.

- Plateau of Productivity: Mainstream adoption starts to take off. Criteria for assessing provider viability are more clearly defined. The technology’s broad market applicability and relevance are clearly paying off.

Explanation source: https://www.gartner.com/en/research/methodologies/gartner-hype-cycle

For Noctiluca, the company listed in NewConnect Market of the Warsaw Stock Exchange, which designs, develops and manufactures next-generation emitters for OLED displays, all the above data and market trends are very favorable. This is also confirmed by our business progress-, our technology is of interest to the major players and some of them are already testing our technology.

For more information on the OLED market and Noctiluca business updates, please visit our International Page on Linkedin